While no one reads the tax code for fun, paying attention to changes and updates pays off for investors. Even small updates in capital gains taxes can make an impact on an individual’s goals and expenses, which is why it pays to pay close attention to recent capital gains shifts under the Tax Cuts and Jobs Act (TCJA).

The TCJA has altered some of the rules and investors should be aware.

Before…

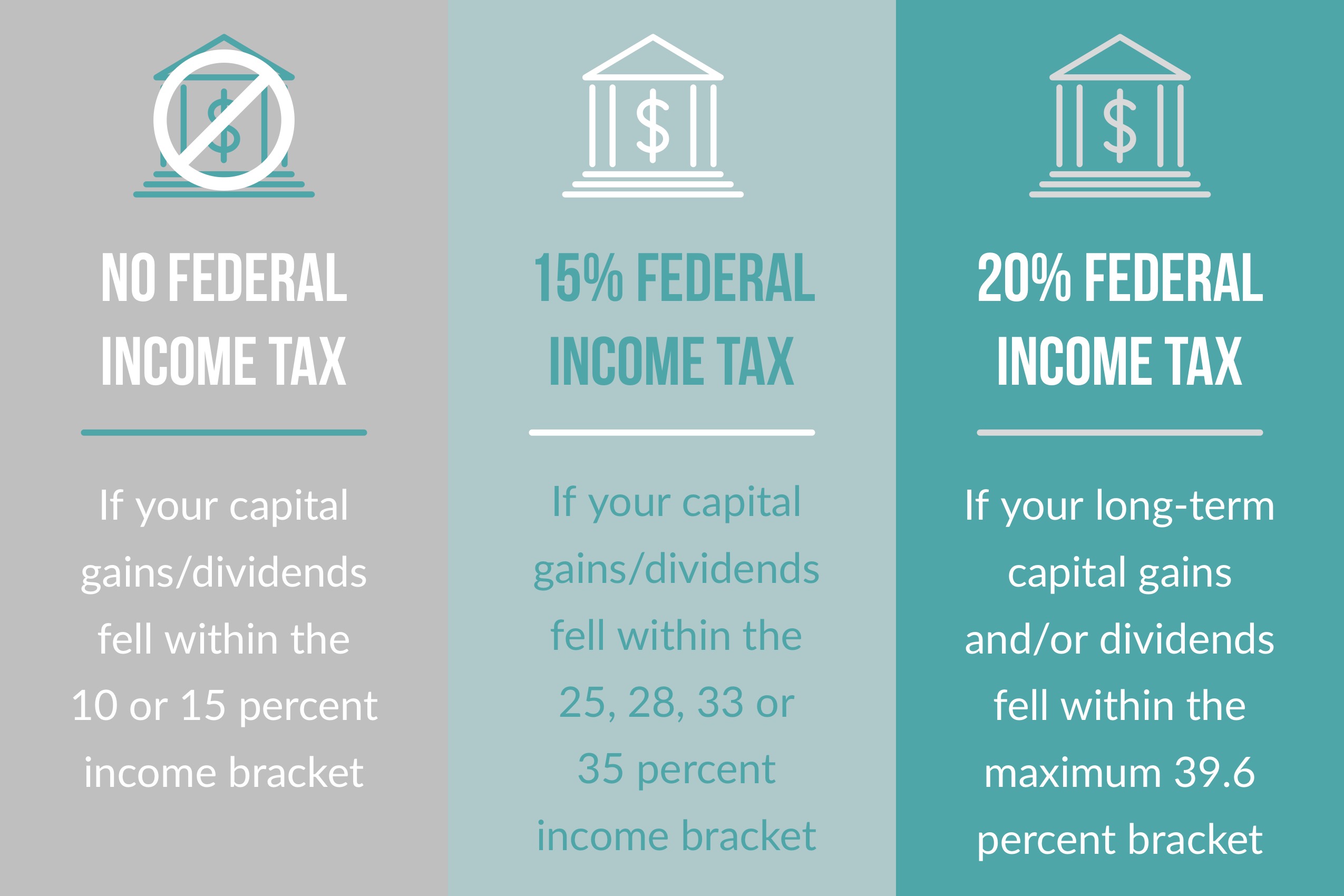

Before the Tax Cuts and Jobs Act was passed, individual taxpayers paid from zero to 20 percent when it came to federal income tax rates on long-term capital gains. How much you paid was linked to your income bracket.

To be specific,

Additionally, many individuals with higher incomes also faced a 3.8 percent net investment income tax (NIIT), further increasing their federal income tax payment and leading to a maximum capital gains rate of 23.8 percent. A component of the U.S. tax law, the NIIT is a surtax designed to supplement revenue from Medicare payroll taxes on earned income, extending to unearned investment income as well.

The earnings thresholds for the additional NIIT tax was as follows:

- Single/head of household: $200,000

- Married, filing jointly: $250,000

- Married, filing separately: $125,000

And After…

The changes are not drastic, but they are worth time and attention. Previously, capital gains were taxed at lower rates than ordinary income, something known as a “preferential rate.” New tax brackets have been introduced, however, preferential rates for long-term capital gains and qualified dividends continue to use the previous tax bracket thresholds. All of this means that preferential capitals gains taxes do not align with the ordinary income tax brackets anymore. The impact on an individual’s capital gains rates will vary based on income.

While the three rates – 0, 15 or 20 percent – remain for long-term capital gains and qualified dividends, these rates are not tied to the new income brackets for the years 2018 to 2025. The following table explains what capital gains currently look like for both individual and married filers:

| Tax Rate | Single | Married, Filing Jointly | Head of Household |

| 0% | $0–38,600 | $0–77,200 | $0–51,700 |

| 15% | $38,601–425,800 | $77,201–479,000 | $51,701–452,400 |

| 20% | $425,801 and up | $479,001 and up | $452,401 and up |

Starting next year, all of these brackets will be indexed to account for inflation. The TJCA maintains the 3.8 percent NITT– this means that tax rates for higher-income earners for the next seven years will be 18.8 percent (15 percent plus the 3.8 percent NIIT) or 23.8 percent (20 percent plus 3.8 percent).

Essentially, while the tax rates remain the same, the brackets are not tied to income tax brackets for individuals.

Naturally, it is always wise to consult with your tax adviser if you have questions or concerns.

Join the conversation

We would love to hear from you