Are you new to Medicare? If so, there are important things you need to know. Retirement is supposed to be the entry point to the “easy life”—the years when the demands of work decrease and opportunities for relaxation, leisure and free time increase.

But many of the decisions retirees have to face as they approach these years are far from easy, especially for those decisions that have an impact on retirement finances. Just take Medicare and health insurance coverage as an example.

Medicare is a significant benefit for those over age 65, but the choices around the program are complex. A wrong choice could cost a retiree a lot of money in out-of-pocket expenses—money they may be able to use for other needs if they make a better choice for their specific situation.

We can’t cover all of the ins and outs of Medicare in a short article. But we can discuss the highlights of the program and address some of the biggest decisions people face when enrolling in Medicare for the first time.

Medicare ABCs (and Ds)

Parts A and B is original Medicare. These plans are administered by Medicare directly. Part A is hospital insurance and covers costs for in-patient hospital stays, along with skilled nursing home care, home health care and hospice care. There are no monthly premiums for Part A as long as you paid Medicare taxes while you were (or are) working.

Part B is medical insurance and covers the costs of doctor visits and other physician services, as well as durable medical equipment. There are monthly premiums for Part B that are based on your income—if your income is higher, your premiums will be too.

Part C is known as Medicare Advantage. These are Medicare plans sold and administered by private insurance companies that follow Medicare guidelines. Part C plans combine coverages for Part A and B, and some may include Part D as well. You can choose a Part C plan if you want health care benefits or coverage for different services than what Parts A and B offer, but you may pay higher monthly premium costs.

Part D is prescription drug coverage. Like Part C, these plans are administered by outside insurance companies approved by Medicare. You can buy this coverage separately if you want it. Monthly premiums vary by plan, but you can expect to pay more for this coverage if you have a higher income.

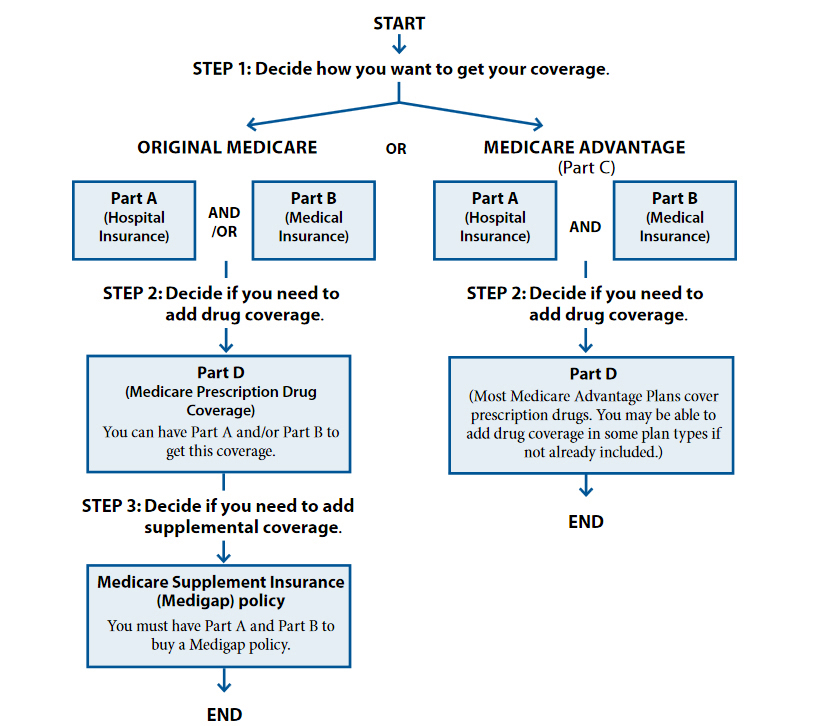

The chart below, provided by the Centers for Medicare and Medicaid Services, helps show how to best view Parts A, B, C, D and Medigap when trying to decide what is best.

Know the Limitations

It’s important to remember Medicare does not cover all health-related costs. The majority of Medicare enrollees have some out-of-pocket expenses for deductibles, copays and other shared costs, beyond what they pay in monthly premiums.

There are also specific limitations to what Medicare covers under Part A. For instance, Medicare covers costs for semi-private hospital rooms under Part A, but not private rooms unless medically necessary. Also, coverage for skilled nursing home care is limited to 100 days, so Medicare cannot be used for long-term care needs.

Additionally, Medicare doesn’t cover a range of dental or vision services under Parts A or B. Dentures, hearing aids and cosmetic surgery are also excluded from coverage.

What about the costs Medicare doesn’t cover? That’s where Medigap coverage comes in. Medigap plans offer supplemental coverage to Medicare Parts A and B to help senior Americans cover their out-of-pocket health care costs. Medigap plans can pay for deductibles, copay and coinsurance. Plus, many may offer coverage for health care services that Medicare doesn’t cover.

Medigap plans are offered by third-party insurance companies, but they’re different than Medicare Advantage (Part C) plans because they cover supplemental costs. To be eligible for a Medigap plan, you must be enrolled in Medicare Parts A and B. Also, Medigap policies only cover one person, so a married couple would have to get two Medigap policies, one for each spouse.

All Medigap policies are required to follow federal and state laws, which are designed to protect you. Policies must be clearly identified as “Medicare Supplement Insurance.” In most states, Medigap insurance companies can only sell you a “standardized” Medigap policy identified by letters A through N. Each standardized Medigap policy must offer the same basic benefits, no matter which insurance company is selling it. The cost is usually the only difference between Medigap policies with the same letter sold by different insurance companies.

How Enrollment Works

Enrollment in Medicare Parts A and B is automatic for anyone already receiving Social Security benefits, starting in the month of your 65th birthday. For those who decide to delay the start of Social Security beyond their eligibility year, enrollment is not automatic—they will have to sign up directly through Medicare.

First-time Medicare enrollees have a seven-month window to apply. The window opens three months before the month of your 65th birthday and closes three months after the month of your 65th birthday. So the seven-month window would include your birthday month as well.

In the initial enrollment period, you can also decide if you want to add the prescription drug coverage (Part D) with Parts A and B, or if you want to go the Medicare Advantage route to combine Parts A and B (and even Part D) under one plan from an outside insurance provider.

Still Working?

The choice to enroll in Medicare gets more complicated if you are covered under a group health insurance plan from a current employer. In general, it is wise for anyone currently working at age 65 to enroll in Part A—this is coverage you’ve already “paid for” through Medicare taxes and most people won’t pay anything additional for Part A.

The story is different for Part B, and it depends on the size of the company you work for. If your company has more than 20 employees, your group health insurance plan will be the primary payer of any health-related costs you claim, so you can hold off on applying for Part B.

But if you work for a company with less than 20 employees, Medicare will be primary payer so you should enroll in Part B. Your group insurance plan may decide not to cover health-related costs that would normally be covered under Medicare Part B, so you could end up paying these costs out of your own pocket.

Another consideration: there is a 10% penalty per year for anyone who does not enroll in Part B when they are first eligible. This penalty wouldn’t necessarily apply to anyone working for an employer with more than 20 employees because there is an eight-month special enrollment period for these workers after they leave their employer-sponsored health plan. But this is an important consideration for workers at smaller companies.

Shop Around at Renewal Time

Health care costs change dramatically from year to year, so you can’t count on your out-of-pocket costs for health services or insurance coverage to remain static either.

Unfortunately, many Medicare enrollees don’t bother to compare options for Medicare Advantage, Medigap coverage or Part D plans during the annual open enrollment period. Insurance companies that sell Medicare plans count on this inertia to keep premium costs high, knowing most enrollees won’t comparison shop when given the opportunity.

Current Medicare enrollees should shop around during the annual open enrollment period from October 15 to December 7. During this time, you can enroll in prescription drug coverage or change your Part D plan. It’s also smart to evaluate your options between Medicare Advantage plans and original Medicare (Parts A & B) every year. You can switch between Parts A and B or a Part C Medicare Advantage plan during any open enrollment period. If you can get better coverage or lower premium costs, it may be worth making a change.

One last piece of advice for individuals looking at their Medicare options—make sure you review your needs and thoroughly understand your choices and the pros/cons of each choice. Also, make sure you check and see if your doctors accept the coverage you are considering as you don’t want to be forced to find another doctor after you have already enrolled in the coverage. Lastly, don’t go it alone, seek the advice of your trusted advisor who can help you with these important decisions.

Join the conversation

We would love to hear from you